north dakota sales tax exemption

How to use sales tax exemption certificates in North Dakota. In North Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Colorado Sales Tax Sales Tax Tax When You Know

Click here to get more information.

. The exemption is available if. Code 57-392-04 Exemptions ND. North Dakota sales tax law provides an exemption for certain sales made to residents of Montana.

The letter should include. This page describes the taxability of services in North Dakota including janitorial services and transportation services. 105-16413 Retail Sales and Use Tax Sales and Use Tax Bulletin see p.

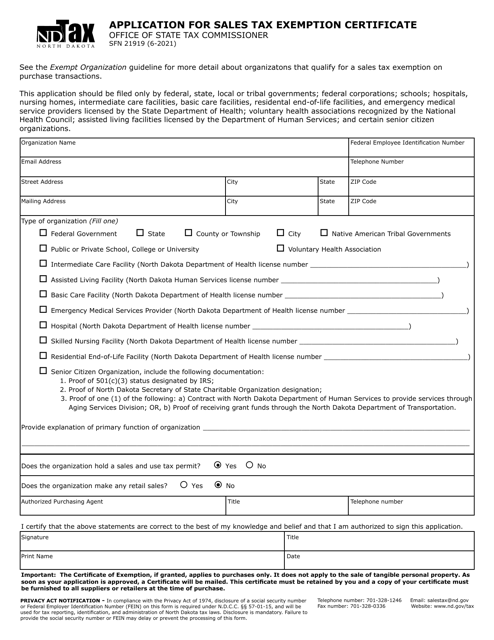

Office of State Tax Commissioner. You can lookup North Dakota city and county. To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail.

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. The range of total sales tax rates within the state of North Dakota is between 5 and 8. Simplify Ohio sales tax compliance.

Use tax is also collected on the consumption use or storage of goods in. Property Tax Credits for North Dakota Homeowners and Renters. The state of North Dakota levies a 5 state sales tax on the retail sale lease or rental of most goods and some services.

The sales tax is paid by the purchaser and collected by the seller. Form 301-EF - ACH Credit Authorization. For purchases made by a North Dakota exempt entity the purchasers tax identification number will be the North Dakota Sales Tax Exemption Number E-0000 issued to them by the North Dakota Office of State Tax Commissioner.

Raised from 7 to 8. Raised from 7 to 75. While North Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Ad Exempt Sales State Tax information registration support. The taxpayers name social security number or federal employer. Form 306 - Income Tax Withholding Return.

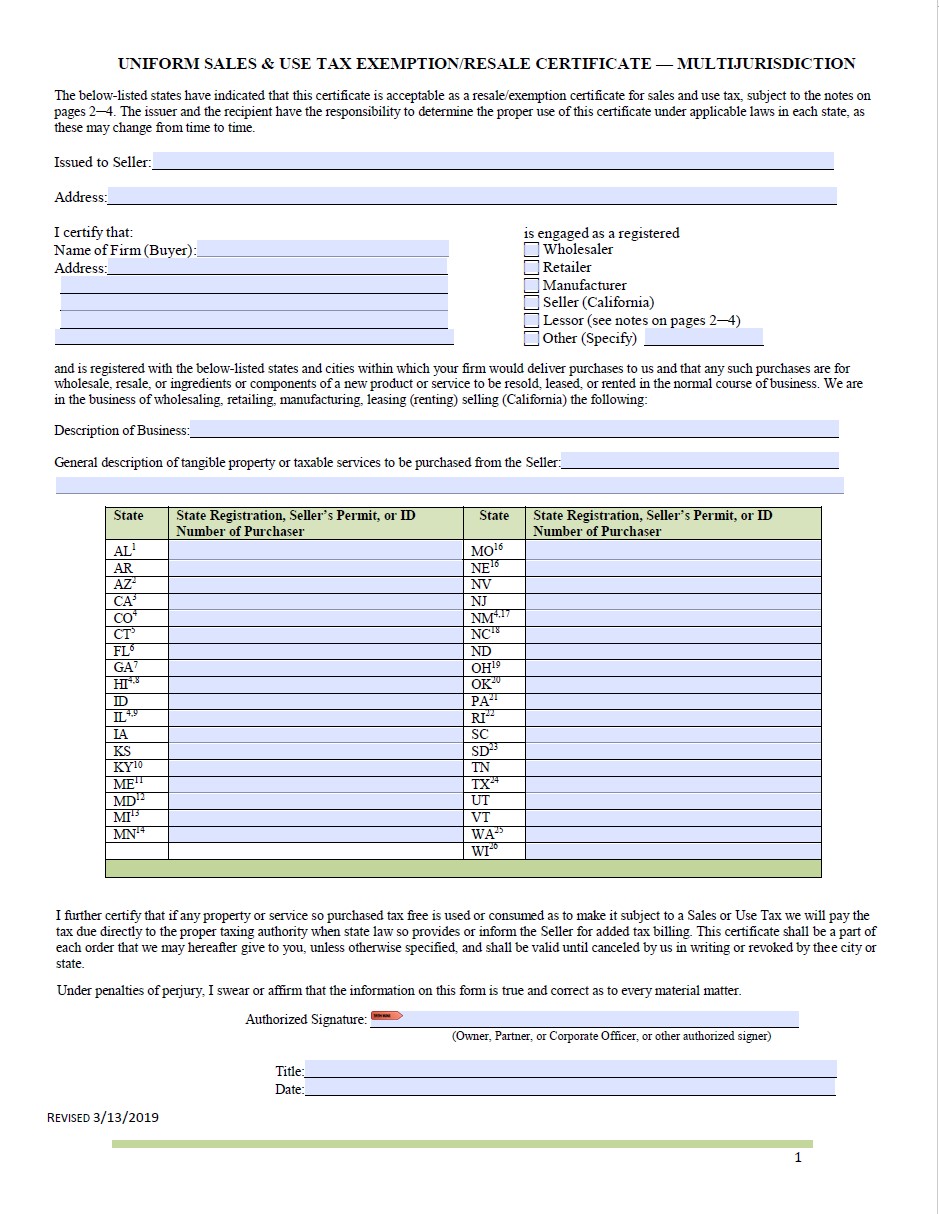

North Dakota sales tax is comprised of 2 parts. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. To learn more see a full list of taxable and tax-exempt items in.

To learn more see a full list of taxable and tax. The state of North Dakota became a full member of Streamlined Sales Tax on October 1 2005. The information on this site is general information and guidance and is not legal advice.

This page describes the taxability of occasional sales in North Dakota including motor vehicles. Improvements to Commercial and Residential Buildings. This is a sales and use tax exemption and refund for machinery or equipment used to produce coal from a new mine in North Dakota.

Diplomatic Sales Tax Exemption Cards. 3 The property will be removed from the State of North Dakota for use. Property Exempt From Taxation.

The Office of State Tax Commissioner is required by law to disclose the amount of any tax incentive or exemption claimed by a taxpayer upon written request from any standing committee chair of the North Dakota Legislative Assembly. Exempt on all purchases. A North Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold without the reseller having to pay sales tax on them.

Homestead Credit for Special Assessments. Exact tax amount may vary for different items. Many states have special lowered sales.

New State Sales Tax Registration. To learn more see a full list of taxable and tax-exempt items in North Dakota. 2022 North Dakota state sales tax.

Seller using school funds. If you hold a North Dakota sales and use tax permit you may file your sales and use tax returns over the. Property Tax Credit for Disabled Veterans.

North Dakota SSUTA ND. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. Name and physical address of the project.

North Carolina North Carolina GS. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders.

Need to complete a Sales Tax Exemption Application TC-160 to receive an exempt certificate. While North Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. While North Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

The exemption for each new mine is limited to the first 5 million of sales and use tax paidThe exemption extends to replacement machinery or equipment if the capitalized investment in the new mine exceeds 20 million. Taxpayer name address Federal Employer Identification Number and North Dakota sales and use tax permit number. Gross receipts tax is applied to sales of.

The maximum local tax rate allowed by North Dakota law is 3. 1 The Montana resident is in North Dakota to make a purchase and not as a tourist or temporary resident. Farm Buildings and Other Improvements.

Diplomatic Tax Exemption Program. 14-16 NC Directive. For specific state guidance contact the state.

Qualifying Veterans and Disabled Persons Confined. Ad Get Access to the Largest Online Library of Legal Forms for Any State. To obtain exemption provide to vendors a copy of the Universitys exemption certificate.

Several examples of exemptions to the state sales tax are prescription medications some types of groceries some medical devices and machinery and chemicals which are used in agriculture. Form NDW-M - Exemption from Withholding for a Qualifying Spouse of a US. Groceries are exempt from the North Dakota sales tax.

Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. Must include IRS determination letter.

2 The taxable sale is 5000 or more. Public schools are considered instrumentalities of state government and are exempt from North Dakota sales and use tax on all purchases made by the school if payment is made directly to the. Registered users will be able to file and remit their sales taxes using a web-based PC program.

Private or parochial schools are exempt from sales tax when purchasing items to be used exclusively in the operation of the school. Local jurisdictions impose additional sales taxes up to 3. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0959 for a total of 5959 when combined with the state sales tax.

Ohio Sales Tax Table at 65 - Prices from 631900 to 636580. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. This page describes the taxability of manufacturing and machinery in North Dakota including machinery raw materials and utilities fuel.

Tax permit number issued to you or your business by the North Dakota Office of State Tax Commissioner. New farm machinery used exclusively for agriculture production at 3. Use exemption code 14 on the Application for Certificate of Title Registration of a Vehicle SFN 2872 North Dakota Department of Veterans Affairs - 4201 38th St S Suite 104 Fargo ND 58104-7535 7012397165.

Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically. Simplify North Dakota sales tax compliance. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process.

Minnesota Bill Of Sale Form For Ibm Storage Equipment Download The Free Printable Basic Bill Of Sale Blank Form Bill Of Sale Template Minnesota Hennepin County

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Finance Function Tax

Sales Tax On Grocery Items Taxjar

North Dakota Sales Tax Small Business Guide Truic

Financial Trusts And Secrecy In The U S Tax Haven Of South Dakota Watch An Excerpt From Frontline And Icij S New Pandora Pa Tax Haven South Dakota Frontline

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Arizona Student Loan Forgiveness Programs Arizona State Of Arizona Arizona State

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax Brackets

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

North Dakota Sales Tax Exemptions Agile Consulting Group

.png)

States Sales Taxes On Software Tax Foundation

Form Sfn21919 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate North Dakota Templateroller